Often when people go into business or start a small business they really don't think through the details of what they are doing day-to-day as it relates to the long term health of the business or their personal financial health.

A classic example is the Personal Guarantee. When you go into business you will need to make financial commitments to various parties like landlords, vendors, etc. Most of these commitments are promises to pay. The real question is "Who is promising to pay?" Is it your company that is promising to pay or is it you personally that is promising to pay...or is it BOTH.

When you go into business did you form a corporation? LLC? Hopefully you did because those things can give you some legal protections that, if something goes wrong, you'll wish you had.

Smart and informed approaches to starting a small business, buying a business, selling a business and small business management. Real world examples, tips, successes and dangers.

Sunday, July 29, 2012

Sunday, June 10, 2012

Using Credit Cards for your Small Business Financing

I see many, many small businesses that use the business owners' personal credit cards to finance their business. Although this is often an easy source of cash it can be a terrible way to manage and grow your small business.

Often the biggest issue we see is that the business owner doesn't understand the relationship between the interest expense on the credit card debt as it relates to the net profits the business generates. We regularly see businesses where they are guaranteed to lose money on the sale of an item which the business owner set the price. Meaning the business owner thought he had priced the product to make a profit but in fact the price guaranteed a loss.

Often the biggest issue we see is that the business owner doesn't understand the relationship between the interest expense on the credit card debt as it relates to the net profits the business generates. We regularly see businesses where they are guaranteed to lose money on the sale of an item which the business owner set the price. Meaning the business owner thought he had priced the product to make a profit but in fact the price guaranteed a loss.

Labels:

Business loans,

financing,

small business accounting

Monday, May 28, 2012

If you ever thought you can turn your hobby into a business.......

Many people we encounter think that starting a business based on a hobby is a good idea...it rarely is.

Maybe they've read too many "Do what you love" seminar headlines. The reality is, it's either a business or a hobby and never both.

This recent article in the Wall Street Journal gives you a look into one persons attempt to turn their hobby into a business.

Maybe they've read too many "Do what you love" seminar headlines. The reality is, it's either a business or a hobby and never both.

This recent article in the Wall Street Journal gives you a look into one persons attempt to turn their hobby into a business.

Point. Set. Match. I Lose!

This article published in The Wall Street Journal Small Business Management Section.

Thursday, May 24, 2012

Small Business Purchase Due Diligence

Buying a small business has many challenges not the least of which is the due diligence process prior to the purchase. Most small business owners run their business with no thought of selling it. Their record keeping and bookkeeping are done for their needs and there is no thought given to how a buyer would view their information.

When buying a small business Due Diligence has 3 basic areas of focus. Two of the three require the assistance of the seller:

Keep in mind that your goal is to buy a good business, not just buy a good bookkeeping system.

Related Posts:

When buying a small business Due Diligence has 3 basic areas of focus. Two of the three require the assistance of the seller:

- Industry Due Diligence: The seller is often the worst source for this information. Many small business owners have no real idea of the industry outside the 4 walls of their business. Get what you can from the seller but be prepared to conduct your industry due diligence with outside resources. Most industries have Trade Associations that can be a good source of information. Here's a link to a Directory of Trade Associations

- Business Operational Due Diligence: This is where the seller has the most information. They usually can give you, the business buyer, every detail of the business process. During due diligence focus on understanding why the seller does something their way. Also, you will likely find that the business seller has not documented their processes very well or more likely at all. When discuss operations with the seller try to take all the notes you can so that you can get focused on the critical areas you need to understand. You'll have plenty of time later to figure out if you want to change something. Keep in mind that you will be replacing the owner so spending time focusing on what the seller actually does day to day is important. You might want to start a specific list and identify evey seller's duty - daily, weekley, monthly, annually.

- Financial Due Diligence: This is the wild card. Different seller's are all over the place on this. I've seen million dollar businesses run from a shoe box and $50,000 businesses with perfect accounting. Don't focus on how they keep their books, just focus on how you can determine from their books if the information is reasonably accurate and you can determine how much money the business is actually making. Most small business financial due diligence starts with bank accounts. Do the deposits made at the bank equal the sales reported for the business? If not, why? Once you pull on that thread it will lead you to other questions.

Keep in mind that your goal is to buy a good business, not just buy a good bookkeeping system.

Related Posts:

Excellent Book about Managing Small Business Finances:

Small Business Financial Management Kit For Dummies

Excellent Document Shredder for Confidential Disposal of Sensitive Materials

Excellent Document Shredder for Confidential Disposal of Sensitive Materials

Sunday, April 22, 2012

Options for Small Business Accounting

Over the years I have tried a variety of small business accounting solutions. A huge leap forward for small businesses is the cloud based small business accounting software. Based on my experience a small business' best option is a "cloud" based solution. A cloud based small business accounting package has some significant advantages and a few disadvantages.

Advantages:

There is also the option of outsourcing virtually all of your bookkeeping to a company. If you want to see what services an outsourced bookkeeping company provides go to GrowthForce they are experts at outsourcing small business accounting services.

Other related posts:

Advantages:

- Your software is always the current version

- You can allow direct access to your outside CPA. This may be the best feature since it allows you to very efficiently book the entries that I used to wait til the end of the month (or quarter, or year, or when the taxes get done). Now when we have something odd to book we simply call the CPA, we login together and the CPA shows us the proper booking, What used to go on someone's "to-do" list is now done correctly the first time.

- You can access your bookkeeping and accounting records from anywhere. Small business owners often complain about being tied down in their chair at the office but you don't need to be.

- You can outsource many activities which a remote user can do part time and at a lower cost because they can access your accounting system. This could save you hiring a full time person or trying to train people to do complex jobs part-time.

Disadvantage:

- There's a monthly subscription fee depending on the level of service you choose.

- Getting your CPA to use something other than Quick Books might be a challenge. But remember, you have to use the system everyday. If you find a system that works better for you than Quick Books have a discussion with your CPA about the benefits to you.

Although Quick Books is the most widely used and certainly a safe choice, I find the Quick Books "on-line" version to be slow and cumbersome.

Other related posts:

Thursday, April 19, 2012

Here's the Cheapest Small Business start-up Experience You Can Buy

Here's a great book about starting a business. A real life recount of the ups and downs and lessons learned the expensive way.

This book will give you the cheapest experience you can buy. Learning from others start-up business mistakes is always better, and lest costly, than learning from your own.

This book will give you the cheapest experience you can buy. Learning from others start-up business mistakes is always better, and lest costly, than learning from your own.

Sunday, April 15, 2012

What on earth is a coverage ratio in financing with an SBA Loan?

When dealing with financing of various sorts you will come across the term "coverage ratio". It my be in the context of "Interest coverage ratio" or "debt coverage ratio" or some other similar nomenclature.

Here's the basic concept of a coverage ratio. The coverage ratio is designed to determine what margin for error there is in a borrower's ability to pay back the debt.

Let's use an example assuming you are buying a business, here are some basics:

Here's the basic concept of a coverage ratio. The coverage ratio is designed to determine what margin for error there is in a borrower's ability to pay back the debt.

Let's use an example assuming you are buying a business, here are some basics:

- Business Purchase Price $500,000

- Seller's Discretionary Earnings (SDE) $175,000 (Seller's discretionary earnings is the business earnings before Interest, Depreciation, Taxes, Amortization and Owner's Compensation).

- Down payment Buyer has available $100,000

- SBA Loan $400,000 financed for 10 years @ 7% = $4,644 per month payment which = $55,750 per year.

- Salary the Buyer needs from business to pay living expenses $100,000.

Coverage Ration Calculation

SDE $175,000

Salary needed $100,000

Available for Debt Service $75,000

Amount of Debt service $55,750

Coverage ratio is 1.35 Amount available for debt service divided by actual debt service.

Generally speaking when seeking an SBA Loan the coverage ratio required will be between 1.25 and 1.4.

Labels:

Business brokers,

buying a business,

cash flow,

SBA Loan

Sunday, March 11, 2012

What Price is the Right Price to buy a Small Business

If you decide you want to buy a business you need to prepare yourself for the rather inconsistent pricing methodologies used for setting the asking prices for small businesses.

You shouldn't confuse the asking price for a business with the value of the business or what finance professionals call a Business Valuation or Business Appraisal. There are many ways to compute the value of a small business. The results can be wildly different and all correct. The issue isn't "what is a business worth?" as much as "what is the business value to you?". We'll breakdown the elements and suggest ways for you to go about the process of determining a fair value for a business.

For background it also might be helpful to read "What do you Buy when you Buy a Business?" . Also, you might want to review this Case Study How to Buy a Business - Case Study.

In this post we will discuss the elements that create small business value. As Business Brokers we have these discussions with buyers but more importantly we have the same discussions with business sellers.

You shouldn't confuse the asking price for a business with the value of the business or what finance professionals call a Business Valuation or Business Appraisal. There are many ways to compute the value of a small business. The results can be wildly different and all correct. The issue isn't "what is a business worth?" as much as "what is the business value to you?". We'll breakdown the elements and suggest ways for you to go about the process of determining a fair value for a business.

For background it also might be helpful to read "What do you Buy when you Buy a Business?" . Also, you might want to review this Case Study How to Buy a Business - Case Study.

In this post we will discuss the elements that create small business value. As Business Brokers we have these discussions with buyers but more importantly we have the same discussions with business sellers.

Labels:

Business brokers,

buying a business,

sell a business

Sunday, February 26, 2012

Small Business Management and Help

Every couple of years I re-read this book and every time I'm glad I did. I bet I've read it at least 7 times.

This year I'm buying a bunch to give out to business owners that seems especially receptive to the idea of creating a great business.

On a side note the Kindle price for this book is higher than the paperback version, does that seem right to you? Not to me.

Anyway, here's a link for it and yes, if you order it thru this link I'll make about 2cents, so thank you in advance, if you do.

Learning from is part of running and changing is needed to be successful over time. Here's a post on old school simple sales and marketing lessons I've learned though experience.

Either way, get your hands on this book if you run a business or should I say if your business is running you. Also, take a look at this article "Can Owning a Small Business make you Wealthy?"

For other interesting blogs from interesting people visit TheHub click here

Saturday, February 18, 2012

Confidentiality when Buying a Business

A lot of things can go wrong when buying a business. Here's some background on the Importance of Confidentiality. If you want to buy a business....understanding this issue can be the difference between buying a business and losing a good opportunity. Below is a short slide presentation:

Library of 20 Articles about Buying a Business

Note: Please note that this information is copyright protected and can not be reproduced without the written consent of Sunbelt Business Brokers Houston Texas or Dan Elliott.

Library of 20 Articles about Buying a Business

Note: Please note that this information is copyright protected and can not be reproduced without the written consent of Sunbelt Business Brokers Houston Texas or Dan Elliott.

Friday, February 17, 2012

30 Second Biz Lesson - Bad Debts!

You better get paid for what you sell or you're going to be doing a lot of catching up.

For other Business information form interesting people visit TheHub click here.

Thursday, February 16, 2012

Timely article on Social Media - Does it Work for Small Businesses?

I have recently been experimenting with a lot of social media platforms with varying degrees of success. This article talks thru the issues and experiences of several business owners. having reading this article I'll definitely be changing my approach. Good read, not too long either.

Click Here to Read the Article...

Click Here to Read the Article...

Tuesday, February 14, 2012

Cash vs Accrual Accounting Made Easy

Drop me a note below if you want me to take a shot at any other small business accounting or financing issues.

Also, look at Expense to profit Cash Conversion Process for more info on working capital and cash management.

Other Articles about Running a Small Business:

Also, look at Expense to profit Cash Conversion Process for more info on working capital and cash management.

Other Articles about Running a Small Business:

- Do you Really want a Business Partner? I mean really....

- Can Owning a Small Business Make You Wealthy?

- Want to Buy a Business? Here's a process..

Don't lose your corporate shield and lose everything!

Here's a quick read about why you need to make sure your corporation is protection for your personal assets.

Understand your risks - Click Here

Also, here you can get many of the legal documents needed to protect yourself and your assets

Understand your risks - Click Here

Also, here you can get many of the legal documents needed to protect yourself and your assets

Monday, February 13, 2012

The best business planning tool?

If you plan to be in business you'd better have a Business Plan. If you plan to start a small business this tool can be the difference between success and losing everything. If you think this Business Plan tool is expensive wait til you see how expensive it is to NOT have a well thought out and written business plan.

If you are considering starting or buying a business it's a good idea to have the best tools. It may cost you a few bucks but it could be a cost that saves you many, many thousands of dollars.

A good business planning tool will also allow you to compare options from a consistent platform.

I think the best Business Plan Software on the market today is Business Plan Pro . (Yes, this is an affiliate link and we get a few cents if you buy it but, hey, give us a break, we did the research).

The best part about this software is it's intuitive and you don't need an MBA to operate it. The Standard edition is all most people ever need. It's a product that has been around for many years and it's very practical and efficient to learn.

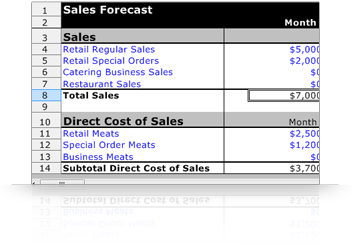

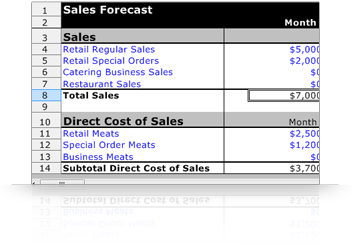

As you can see the layouts are clean and easy to understand.

If you are going to get into business you need a plan that is logical, well thought out and proven. Trust me, if you go to your banker with a professional business plan your odds of getting financing improve dramatically. A plan like the one Business Plan Pro produces will be a requirement for any SBA loans that you apply for or pursue.

Here's a few fatal mistakes a good business plan can help you avoid.

The best time to have a business plan is before someone asks you to see it! Get ahead of the curve...get your plan.

If you are considering starting or buying a business it's a good idea to have the best tools. It may cost you a few bucks but it could be a cost that saves you many, many thousands of dollars.

A good business planning tool will also allow you to compare options from a consistent platform.

I think the best Business Plan Software on the market today is Business Plan Pro . (Yes, this is an affiliate link and we get a few cents if you buy it but, hey, give us a break, we did the research).

The best part about this software is it's intuitive and you don't need an MBA to operate it. The Standard edition is all most people ever need. It's a product that has been around for many years and it's very practical and efficient to learn.

As you can see the layouts are clean and easy to understand.

If you are going to get into business you need a plan that is logical, well thought out and proven. Trust me, if you go to your banker with a professional business plan your odds of getting financing improve dramatically. A plan like the one Business Plan Pro produces will be a requirement for any SBA loans that you apply for or pursue.

Here's a few fatal mistakes a good business plan can help you avoid.

The best time to have a business plan is before someone asks you to see it! Get ahead of the curve...get your plan.

Tuesday, February 7, 2012

Business Buyers 7 Deadly Sins

Buying a Business - The 7 Deadly Sins

Buying a business could be the best decision for you but you need to approach the task methodically and with a clear understanding of yourself as well as the businesses you consider. Here are the mistakes many business buyers make.

We call them the Business Buyer’s 7 Deadly Sins:

Buyer Sin #1

Buyer’s failure to seriously investigate and understand their personal financial situation before they begin the process of investigating businesses to buy. How much ready cash do you really have for a down payment? Where is it? Will your family and friends really back you? What are the tax consequences of accessing the cash (401k/IRA)?

Buyer Sin #2

A Buyer’s failure to understand how much money they need to live on, month-to-month. This is often called your “burn-rate”, which needs to be absolutely as accurate as possible, by month, for at least 1 year.

Buyer Sin #3

A Buyer’s failure to understand the difference between profits and cash flow. Profit is what the books say the business made. Cash flow is what cash, the owner, can actually use. You can’t spend profits, you can only spend cash. You can have a lot of profits and no cash.

Monday, February 6, 2012

Monday, January 30, 2012

Sunday, January 22, 2012

Big Ideas for your business? A lesson from Burger King's new big idea.....

Is your new big idea simply an attempt to escape your poor execution of your last big idea?

I often see business owners trying to do too many things and they don't do any particularly well.

Today I read a news report that burger king is experimenting with home delivery. My first reaction was...what a terrible idea. Then I gave it some additional thought and decided yep, it is absolutely a terrible idea.

Burger king has been an under performing biz for as long as I can remember. They seem to go from one idea to the next in an apparently useless attempt to hit the jackpot.

When i read the article I said to myself "really? Home delivery? How about you focus on getting me hot French fries at the drive in window. That would be outstanding!"

How good would it be know that every time you pulled into the BK drive-in you got fresh hot fries? I think that would generate real biz.

When I think about home delivery for BK I think..."why on earth would I want to wait for mediocre BK food when I can wait the same amount of time for decent food?"

The question for you is this. Does your business do a few things very, very well or many things all done poorly?

I often see business owners trying to do too many things and they don't do any particularly well.

Today I read a news report that burger king is experimenting with home delivery. My first reaction was...what a terrible idea. Then I gave it some additional thought and decided yep, it is absolutely a terrible idea.

Burger king has been an under performing biz for as long as I can remember. They seem to go from one idea to the next in an apparently useless attempt to hit the jackpot.

When i read the article I said to myself "really? Home delivery? How about you focus on getting me hot French fries at the drive in window. That would be outstanding!"

How good would it be know that every time you pulled into the BK drive-in you got fresh hot fries? I think that would generate real biz.

When I think about home delivery for BK I think..."why on earth would I want to wait for mediocre BK food when I can wait the same amount of time for decent food?"

The question for you is this. Does your business do a few things very, very well or many things all done poorly?

Subscribe to:

Comments (Atom)